A reverse house loan is often a economical Software that enables homeowners, commonly seniors, to convert a percentage of their dwelling equity into money without having to provide their household or make regular monthly payments. This kind of mortgage is created for all those who have constructed up sizeable equity of their properties as time passes and wish to utilize it to nutritional supplement their cash flow, buy health care costs, or take care of every day residing costs. A lot of homeowners in the United states take a look at this option as a means to take care of monetary independence all through retirement. Unlike traditional financial loans, in which borrowers make frequent payments to a lender, reverse home loans present payouts on the borrower, which may be acquired being a lump sum, month to month installments, or maybe a line of credit.

Inside the United states of america, reverse home loans are well-known amongst retirees seeking ways to stabilize their finances. These financial loans are secured by the worth of the residence, and repayment turns into owing only once the borrower now not life in the home, whether due to marketing the home, going into long-time period treatment, or passing away. The stability owed will incorporate the principal borrowed, accrued curiosity, and any connected service fees, which are generally compensated with the sale of the home. The pliability supplied by reverse mortgages is one of the good reasons they remain a popular option for seniors who want to age in position whilst accessing the resources they need to have.

A specific style of reverse mortgage loan, referred to as the HECM, or Dwelling Equity Conversion Property finance loan, is broadly Employed in the USA. These federally insured financial loans are controlled to make certain borrowers are shielded from owing over the house's value at time of sale, although housing industry fluctuations lessen the property’s value. Borrowers interested in HECM reverse mortgages generally have to have to meet eligibility demands, together with becoming at the least sixty two decades old, owning the home outright or possessing a major number of fairness, and dwelling in the house as their Most important home. Understanding the nuances of this type of loan, which includes its eligibility requirements and fees, is essential for any person taking into consideration this money solution.

For the people inquisitive about the fiscal implications, a reverse home finance loan estimate can provide clarity. Calculating prospective payouts requires thinking about a number of elements, such as the homeowner’s age, the value from the property, present-day fascination charges, and any existing property finance loan harmony. On the internet calculators tend to be utilized to make an approximate figure, but consulting that has a fiscal advisor or perhaps a personal loan skilled can provide extra customized insights. Homeowners often use this facts to weigh the advantages and disadvantages of taking out a reverse house loan in comparison to other money methods readily available throughout retirement.

Among the list of typical misconceptions about reverse mortgages is they contain promoting the home or shedding possession. However, the homeowner retains the title assuming that they fulfill the loan obligations, including spending residence taxes, maintaining homeowners insurance policy, and trying to keep the residence in superior situation. Knowing these duties is critical for guaranteeing the reverse home finance loan continues to be in fantastic standing. On top of that, opportunity borrowers should carefully evaluate all associated costs, including origination fees, mortgage insurance rates, and closing expenses, as these can impact the general worth of the mortgage.

Many people have questions on the pitfalls and benefits of reverse home loans. These loans can be a effective Resource for individuals who need use of income but do not would like to relocate or downsize. Even so, they are not suited for everyone. It is crucial to contemplate long-expression financial ambitions, long term housing options, and also the effect on heirs who might inherit the house. Reverse home loans lessen the equity in the home, which may have an affect on the amount passed on to close relatives. This thing to consider is often a major variable for homeowners who are weighing their alternatives.

The strategy of reverse home loans in the USA has become surrounded by myths and misunderstandings. Some people today feel that they will drop their properties or the loans are only for the people experiencing economical hardship. However, reverse home loans are designed to offer flexibility and financial freedom to homeowners of their afterwards decades. With the right know-how and setting up, they are often a useful resource for masking professional medical expenditures, household renovations, or maybe journey costs. Educating oneself concerning the loan conditions, repayment possibilities, and tax implications is essential for earning an knowledgeable selection.

Another component value exploring is how reverse home loans differ from other money items. In contrast to dwelling equity financial loans or lines of credit rating, reverse home loans tend not to need every month repayments. This characteristic is especially attractive to retirees who can have restricted profits streams and want in order to avoid additional fiscal burdens. However, curiosity carries on to accrue on the mortgage harmony, which can expand after some time. Borrowers should take into account how this tends to impact the remaining equity within their properties and irrespective of whether it aligns with their financial objectives.

One of many 1st techniques in analyzing whether a reverse home loan is best for you is knowing its rewards and likely downsides. Even though it provides access to house fairness without the need of demanding the borrower to offer their house, the bank loan could be costly when factoring in fees and desire. It is usually essential to look at different choices, such as advertising the home and downsizing or taking out a conventional residence fairness bank loan. Every possibility includes its own list of Advantages and worries, and selecting the ideal one particular depends upon particular person situations and economical targets.

A reverse mortgage estimate can serve as a handy starting point for deciding the viability of the monetary Resource. By inputting details like the age with the youngest borrower, the worth of the home, as well as the personal loan kind, homeowners might get a clearer photograph of what they could receive. These estimates usually are not binding but can provide a normal idea of What to anticipate. Expert assistance can even further refine these projections and assistance borrowers know how different payout alternatives, for example fastened regular payments or simply a line of credit history, might fit into their General economic program.

Additionally it is crucial to recognize the function of interest rates in reverse mortgage calculations. Lower desire premiums commonly cause larger payouts, as they cut down the expense of borrowing in opposition to the home’s fairness. Conversely, larger prices can Restrict the amount a borrower can access. Preserving monitor of marketplace traits and consulting with fiscal professionals can help homeowners lock in favorable phrases that maximize the advantages of a reverse property finance loan.

For most people, the choice to pursue a reverse home finance loan entails very careful consideration of non-public circumstances and prolonged-term strategies. Homeowners who foresee living in their existing home for quite some time usually obtain reverse mortgages interesting, as they offer a means to access funds without the need of disrupting their living arrangements. Even so, individuals that strategy to move while in the in the vicinity of long term or whose properties call for considerable routine maintenance may need to discover other available choices to realize their fiscal aims.

Being familiar with the economical tasks tied to reverse home loans is yet another critical component of constructing an knowledgeable determination. Borrowers are necessary to keep up with property taxes, homeowners insurance coverage, and maintenance costs. Failing to fulfill these obligations may lead to the financial loan getting to be because of, which could lead into the sale with the house. Remaining proactive about these requirements is important for preserving the main advantages of the reverse house loan arrangement.

The idea of reverse home loans continues to evolve as more homeowners examine strategies to take advantage of of their home fairness throughout retirement. Irrespective of whether thinking of a HECM reverse mortgage loan or A further form of reverse mortgage product or service, people really should method the choice with a transparent understanding of the linked costs, Rewards, and threats. Accessing Expert assistance and conducting complete analysis are very important steps in making certain that this fiscal Software serves its supposed objective with no developing unintended challenges.

The complexities surrounding reverse mortgages within the United states underscore the significance of watchful scheduling and educated conclusion-making. Whilst they offer a viable Option For lots of retirees looking to improve their financial circumstance, they also require a deep idea of the conditions and terms. Homeowners really should make the effort To judge how this mortgage kind suits into their broader retirement system, looking at both equally fast wants and lengthy-time period aims.

By addressing these factors and looking for individualized assistance, homeowners could make self-assured selections about regardless of whether a reverse mortgage aligns with their money targets. With the right arranging, this monetary Resource can provide the flexibleness and resources necessary to love a secure and cozy retirement. Comprehending the ins and outs of reverse mortgages, together with how they differ from other available choices, makes certain that borrowers are well-ready to reverse mortgage usa navigate this significant economical option.

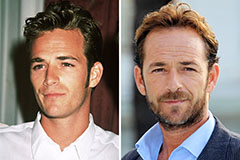

Luke Perry Then & Now!

Luke Perry Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!